Newcomers should prepare for a challenging year as the cost of living in Canada is expected to rise further in 2024.

A recent report from the Royal Bank of Canada titled Navigating 2024: Reset and Revival In A Reshaping World, which looks at local and global events that could affect Canada’s economy in 2024 and the years to come, states that the rising cost of living “squeezing purchasing power” will make it harder for the residents, especially low-income households, to manage their expenses.

The report warns people to embrace “shrink-sumption,” where rising costs mean they must allocate more money to their daily essentials while foregoing purchases of expensive goods.

The report added that trends expected in 2024 include less demand for discretionary items such as eating out, travel and shopping. Canadians may be unable to pay their debts on time and seek out cheaper alternatives for services. They will also be looking for ways to supplement their income. The country may experience fewer job vacancies in 2024 as well.

Jack Jedwab is the CEO and president of ACS-Metropolis, a Montreal-based non-profit that conducts research into issues around migration, inclusion and integration.

“Many middle-income Canadians and newcomer barriers are closely tied to how the labour market evolves,” he said, and recommends a coordinated effort to help newcomers settle in better, calling for “a concerted effort from the industry, employment, and immigrant service sectors to ensure that obstacles to labour market entry are removed, skills are recognized, and that there is support for adjustments via up-skilling, networking, and mentorship.”

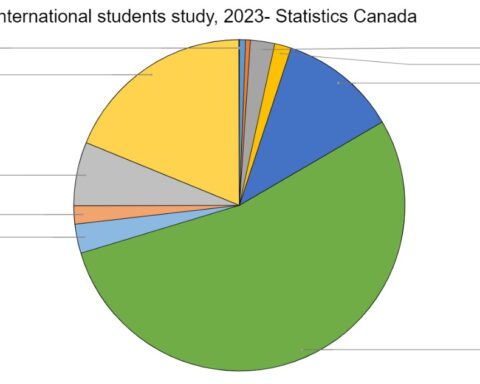

Canada’s foreign population continues to increase year on year: There were 550,187 study permit holders in 2022, up from 445,776 in the previous year, according to Canada’s Annual Report to Parliament on Immigration. The number of temporary foreign workers also rose to 604,382 in 2022, up from 415,817. In 2022, 437,539 permanent residents also came to Canada, rising from 405,999 in 2021.

A Labour Force Survey released by Statistics Canada in December 2023 revealed that nearly six in 10 immigrants (58.2 percent) in the labour force have faced challenges in finding work in their field over the last two years.

With so many new people vying for jobs and with work currently hard to come by, Navi Dhanoa, an employment consultant in Toronto, said newcomers need the motivation and willingness to work hard, ensuring their skills prepare them for employment in Canada.

“Many newcomers don’t seem to be driven for higher-level roles yet,” he said. “They don’t have higher education, and their command of the English language is not at a level where it should be even to get some customer service jobs.

“However, as saving money is difficult anyway in the current scenario, upskilling through higher education remains out of the reach of the majority of newcomers.”

Food prices rose 7.8 percent in 2023, while the costs of rent also increased by 6.5 percent in 2023, according to Statistics Canada. NCM spoke to international students and permanent residents in Canada to get their perspective on how rising costs were affecting them.

Pavan Ahuja came to Canada from India in February 2022, landing a job a month later. Rising costs in Toronto, however, forced him to move outside Toronto in November last year. He has now moved to Ontario’s Waterloo Region, where costs are relatively cheaper.

“Ever since I moved to Canada, the cost of living has seen a very quick upward trajectory and unfortunately hasn’t been what I had expected,” he said. “I definitely believe staying in larger cities like Toronto has started becoming very difficult in terms of living costs.

“Savings are definitely a challenge, but everyone should put aside a minimum amount every month as any unfortunate situation can come up without notice.”

Ahuja said he spent about $3,200 a month in Toronto on rent, utilities and groceries, and noticed a steady increase in his cost of living, especially for groceries and non home-related expenses. In the Waterloo Region, he is able to enjoy a larger apartment for the same rent.

Goodman Moses came to Canada from Nigeria to complete a two-year graphic design course, and continues to work with production companies and startups back home to pay his costs here. As a student, he is required to deposit $10,000 with a bank in Canada to sustain himself while he studies. Called a GIC (Guaranteed Investment Certificate), that amount will last him for his first year, but he is worried that the savings he earned before coming to Canada will not be enough to last once his GIC ends.

“The amount of money I spend at a fast food restaurant in Canada is similar to the amount I would spend at a five-star hotel back home,” he said. “I survive by making smart purchases by mainly buying things available at a discount, but if costs were lower, I would not need this extra income.”

Daniela Vargas came from Chile to study filmmaking, and she too is feeling the stress of meeting her expenses in Canada.

“I do receive freelance work from back home, earning between $600 and $2,000, but it fluctuates and only covers part of my expenses,” she said. “Seeking a part-time job in my field is crucial to managing expenses.”

Despite the challenges, many from the developing world are still keen to come here to build their lives, said Anupama Vijaykumar, founder of Trivium, an India-based think tank that focuses on geopolitics and foreign policy.

“There are concerns around economic conditions and a difficult job climate in much of the developed world, but for much of the developing world, this is seen in relation to what they experience at home,” she said.

“In a lot of the developing world, there is an increase in the number of qualified, well-educated youth, and not enough jobs to go around.

“The idea of the American Dream or the Canadian Dream itself is sold on the idea that hardships will inevitably lead to success. Often, a lot of it has to do with word of mouth, publicity and social media. When someone sees an Instagram reel of a friend living life through Canada’s dreamy autumn/winter, the dream is sold to them.”

Gautam is a journalist, editor and content writer skilled in both digital and print media, who brings with him more than a decade of editorial experience across five countries, including Canada and the US. A member of the Canadian Association of Journalists, Gautam worked as Deputy Editor of the Times of Oman before moving to Canada, where he continues to write on healthcare, education, human interest stories, sport, lifestyle, and science and tech. Gautam has a Masters' Degree in journalism from the UK, and is fluent in both English and French. He lives in Toronto.

Amrita is an NCM-CAJ Collective Member, journalist and content writer, with nearly a decade of experience in content development and journalism in three countries. She started her career as a journalist with a leading daily, The Statesman, in India. She has also led content and editorial teams for several web content management firms. Amrita served as a Communications and Content specialist for some non-profit organizations like the American Red Cross after her move to the U.S. Based out of Toronto, she continues to follow her passion by reporting on human rights violations, education, crimes, inequality and community engagement. Amrita holds a Post Graduate Diploma in Print Journalism from Chennai, India.